Uses Chatbots in the Financial Services

In the industry in which your business operates, the quality of customer service always changes the rules of the game. Between two companies that offer the same products at the same prices, the preferred brand is the one that has excellent customer service. And with increased demand for financial services.

This competition has led to an increase in the number of chatbots in the financial services industry in an attempt to provide the best service to as many customers as possible.

Checkout Landbot

The Most Intuitive No-code Chatbot Builder

Convert leads, capture data, and personalize client journeys in real-time.

The main benefits of chatbots

Most of the chatbots you see on different websites and social platforms seem too simple to meaningfully transform your business processes. However, with the right planning and programming, chatbots in financial services can offer banks the following benefits:

Active customer engagement

Bbank can afford a team of agents who work around the clock and seven days a week, its clients may have to wait until the working hours of answers to their requests. The chatbot will reduce waiting times and will keep the customer interested and informed even on weekends and evenings.

Chatbots can go beyond answering frequently asked questions. They can also be programmed to resell or cross-sell financial products based on a previous transaction history and transfer more complex requests to a human agent. In addition to communicating with customers, they can distribute bank news or financial advice to customers when they browse the website.

Extended customer feedback collection

If the bank does not do this strictly, collecting customer feedback is not usually part of the transaction process.

Some customers are hesitant to leave reviews for privacy reasons or because they feel it doesn’t matter.

When they give feedback, they prefer a conversational approach rather than answering questionnaire questions.

A chatbot with the ability to collect customer feedback can help convince customers that the bank will protect their personal information and take reviews seriously.

When you combine a chatbot with artificial intelligence and big data, it can identify common customer pain points and alert decision-makers to the need for change.

Reducing total costs

The cost of a chatbot can vary depending on what you want. If you plan to deploy a chatbot to get updates and answers to frequently asked questions, the cost of development will be relatively low.

But for more complex transactions, such as money transfers or balance check, it will be more expensive.

The platform you’ll use will also play a role in determining the cost: a chatbot created on Facebook Messenger will cost several thousand dollars, and a special chatbot for a business site can cost up to ten times more.

However, code-free technology allows even the smallest business to create a chatbot in just a few minutes!

Compared to the cost of recruiting and training a team of customer service professionals, the cost of developing a chatbot is much lower. And the chatbot never takes a day off and does not get sick!

Increased efficiency

You may be wondering why we compare one chatbot to a group of customer service agents. It all comes down to power and speed.

the agent can only focus on one customer call. The level of customer service remains at the same level, even if the chatbot handles multiple requests at the same time.

In addition, the Process Robotic Automation Technology (RPA) allows chatbots to significantly reduce the time it takes to process certain transactions.

You can see the impact of chatbots on your typical employee schedule. Instead of getting caught up in routine tasks that bring little to the company.

24/7 Customer support

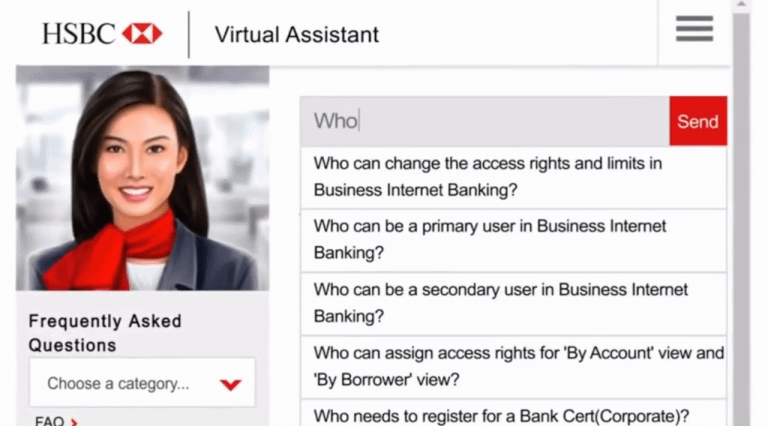

The Chinese banking market is growing rapidly, and recognized industry players often have to hold back attempts by startups specializing in disruptive technologies.

Source: Owner | Landbot

Source: Owner | LandbotMany chatbots have been used in China since 2013, when Tencent announced a bot platform based on its popular WeChat app.

The technology became popular quite quickly as companies used it to interact with their customers 24/7.

Enhanced customer information

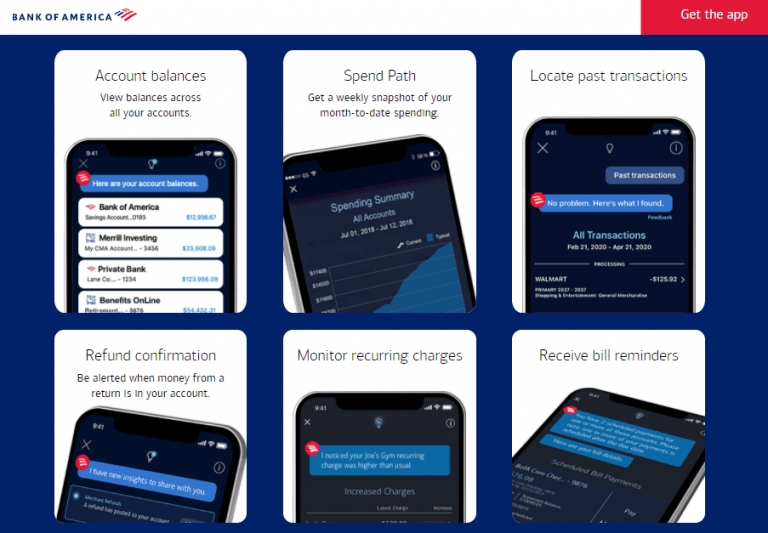

Since its first launch in 2018, the Erica Bank of America chatbot has attracted more than 10 million users.

The first phase of the project included basic banking functions, including card activation and deactivation, money transfer, transaction history, bill payment, and meeting planning.

BofA has announced Erica Insights, a suite of tools for personal finance management based on artificial intelligence. It includes FICO score, account reminders and recurring payments, and weekly snapshots of monthly expenses.

Personalized financial services

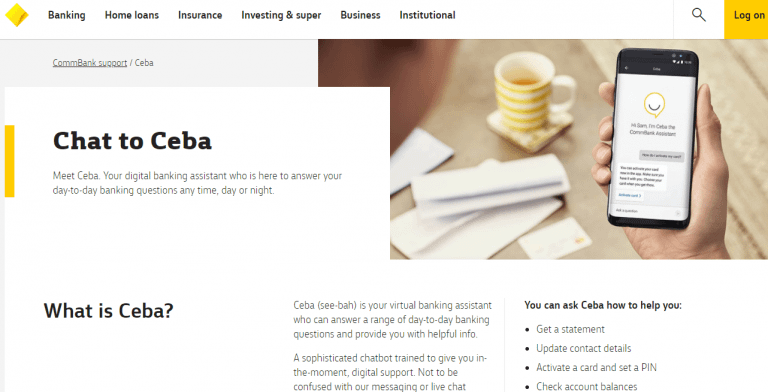

Banking chatbots have also been deployed in Australia, where Commonwealth Bank, one of the country’s largest financial institutions, has launched a chatbot called Ceba.

Ceba has assisted customers with more than 200 tasks, including receipt of balances in accounts, payment, activation of loans, and opening a new account.

Source: Owner | Landbot

Source: Owner | LandbotAutomating back-office tasks

Part of the client experience is what happens when they don’t talk on the phone to an agent.

Although most of the chatbots discussed here are client-oriented, it makes life easier for thousands of lawyers and credit professionals.

The chatbot uses machine learning to reduce the time it takes to check credit agreements to a few seconds.

The chatbot is located in the bank’s own private cloud, and customers’ personal information is safe.

Conclusion

Chatbots are becoming cheaper and easier to deploy, and even the smallest banks and financial companies will soon be able to afford their chatbot.

We are just beginning to understand what financial services chatbots can do with other technologies such as big data, artificial intelligence, machine learning, and natural language processing.

The possibilities are endless. Whether it’s combining a chatbot with virtual reality to demonstrate savings and costs, using facial recognition for banking without touching, integrating mobile apps and chatbots with the Internet of Things for voice transactions, or even providing real-time blockchain or cryptocurrency updates.

To improve customer service. Customers know if there is a chatbot just for a tick or it really helps in this.

The post Uses Chatbots in the Financial Services appeared first on Easi Solve - Essentials Solutions by Shayan Ahmed

from Easi Solve https://ift.tt/3nm8dy7

via IFTTT

Comments

Post a Comment